As we look ahead to 2025 and 2026, the global economic landscape isn’t presenting a unified front. Instead, it’s telling a story of a great divergence. While the world’s top economies, as a whole, are projected to maintain steady growth, a closer look at the data reveals a starkly divided picture. On one side, emerging markets are hitting the accelerator, powered by demographic shifts and digital transformation. On the other, the world’s traditional advanced economies are stuck in a low gear, grappling with structural headwinds.

This Geeks Economy deep dive unpacks the latest OECD forecasts for the G20, exploring the data behind this two-speed world and analyzing the underlying forces that are setting the stage for a potential rebalancing of global economic power.

Steady Growth with a Hidden Story

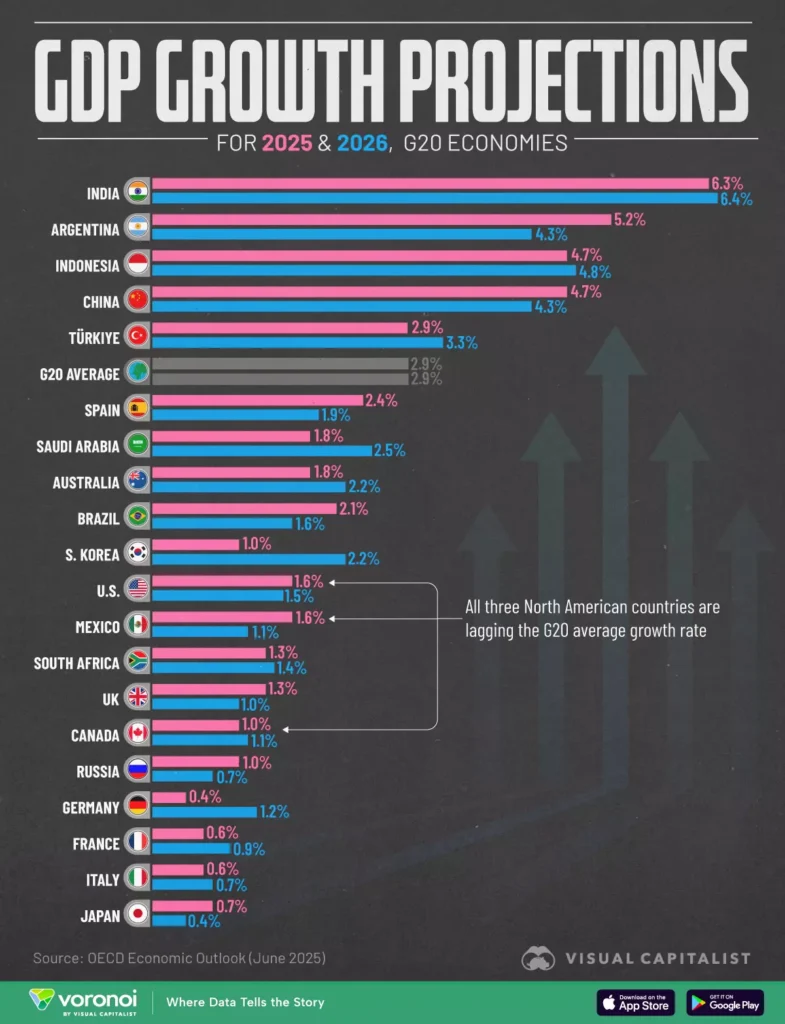

According to the Organisation for Economic Co-operation and Development (OECD), the G20 economies are forecast to grow by 3.0% in 2025 and a slightly stronger 3.1% in 2026. On the surface, this paints a picture of stability. But as any good geek knows, the headline numbers often mask the more interesting trends.

The real story lies beneath the average, in the profound split between the high-growth engines of the Global South and the sluggish performance of the established Western economies.

India and the Emerging Market Powerhouses

The clear leader of the G20 growth pack is India, projected to expand by a blistering 6.6% in 2025 and 6.7% in 2026. This isn’t a random spike; it’s the result of several powerful, converging forces:

- Digital Public Infrastructure: The “India Stack,” a set of open APIs for identity, payments, and data, has unlocked massive economic activity and financial inclusion.

- Demographic Dividend: India boasts a young, growing, and increasingly skilled workforce, providing a powerful engine for consumption and production.

- Infrastructure Investment: Significant government spending on both digital and physical infrastructure is creating a more efficient and connected economy.

India is not alone in the fast lane. Other emerging economies are also set to post strong growth in 2025, including:

- Indonesia: 5.2%

- China: 4.9%

- Turkey: 3.4%

- Saudi Arabia: 4.1%

These figures highlight a clear trend: the centers of global economic dynamism are shifting.

Europe’s Struggle with Stagnation

In stark contrast, many of Europe’s largest economies are facing a period of anemic growth.

The slowest-growing G20 economy is projected to be Germany, with a forecast of just 1.1% growth in 2025. This isn’t a cyclical blip but reflects deeper structural issues:

- Energy Costs: The German industrial model, heavily reliant on manufacturing, is still grappling with higher energy prices following the shift away from Russian gas.

- Export Reliance: Germany’s economic health is tightly linked to global trade. In a world of slowing global demand and geopolitical friction, its export-heavy model is facing significant headwinds.

- Demographics: An aging population presents long-term challenges for labor supply and productivity.

Other major European economies are in a similar boat, with France (1.3%), Italy (1.0%), and the United Kingdom (1.5%) all projected for sluggish growth in 2025.

The U.S. and the Middle Ground

The United States finds itself in a unique middle position, with a respectable but moderating growth forecast of 2.0% in 2025. The U.S. economy has shown remarkable resilience, powered by a strong labor market and robust consumer spending. However, it continues to face its own challenges, including the lingering effects of the Federal Reserve’s aggressive rate-hiking cycle aimed at taming inflation.

This G20 forecast is more than just a collection of numbers; it’s a data-driven snapshot of a world in transition. The clear divergence between high-growth emerging nations and low-growth advanced economies signals a long-term structural shift, not just a temporary anomaly.

For investors, entrepreneurs, and policymakers, this data poses critical questions. Does this trend indicate a permanent rebalancing of global economic power? What opportunities arise from the hyper-growth in markets like India and Indonesia? And what structural reforms are needed for the economies of Europe to break out of their low-growth trap?

Understanding the “why” behind these numbers—the interplay of demographics, technology, energy policy, and digital infrastructure—is the real challenge. For geeks of the economy, this is a fascinating and complex system to analyze, and its evolution will define the financial and geopolitical landscape for years to come.